ct sales tax on cars

Connecticut charges 635 sales and use tax on purchases of motor vehicles. For vehicles that are being rented or leased see see taxation of leases and rentals.

Connecticut Vehicle Sales Tax Fees Calculator Find The Best Car Price

In addition to taxes car.

. If you want to keep up on any changes make sure. If you purchase a vehicle instead of lease it you are paying sales tax on the entire value of the vehicle sales tax in Connecticut is 635 or 775 for vehicles over 50000 and it is based. Car sales tax is pretty straightforward in Connecticut635 on cars under 50000 and 775 on cars over 50000.

Page 1 of 1. 2022 Connecticut state sales tax Exact tax amount may vary for different items The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. Sales Tax Relief for Sellers.

The sales tax rate of 635 applies to the retail sale lease or rental of most goods including digital goods which are described in Special Notice 2019 8 Sales and Use Taxes on Digital. The sales tax is 775 percent for vehicles over 50000. Tax Exemption Programs for Nonprofit Organizations.

Calculate Car Sales Tax in Connecticut Example. A tax rate of 775 applies to the following. The answer depends on whether the resident paid any sales tax to the state in which the vehicle was purchased.

In the state of Connecticut sales tax is legally required to be collected from all tangible physical products being sold to a consumer. 635 Sales Tax Rate Over 50000. Rental Surcharge Annual Report.

Page 1 of 1. Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. Dry Cleaning Establishment Form.

In such a sale the buyer must pay the required state tax on the transaction when he or she registers the car with the Department of Motor Vehicles. Effective July 1 2011 certain motor vehicles with a sales price of more than 50000 are. The sales tax is 635 percent for vehicles purchased at 50000 or less.

Initial Car Price 1. The sale for more than 50000 of most motor vehicles the sale for more than 5000 of jewelry whether real or imitation the sale for more. Connecticut collects a 6 state sales tax rate on.

Sales tax is charged at a rate of 775 for any vehicle registered as. Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. 30000 Initial Car Price 2.

Health Care Provider User Fees. The tax due in is called use. In Connecticut the vehicle tax will be 70 for residents and 30 for businesses.

Effective July 1 2011 the general sales and use tax rate increases from 6 to 635. Where the repaired motor vehicle is owned by and used in carrying on a business Connecticut use tax must be reported and paid on such purchases by filing a Form OS-114 Connecticut. Several examples of exceptions to this tax are certain.

The mill rate for car tax is computed to be 70 for residents and 30 for businesses. 65000 Sales Tax Rate Under 50000. Sales tax is charged at a rate of 635 vessels and trailers that transport vessels are at 299 sales tax rate.

Any 1991 model year and newer passenger vehicles and light duty trucks purchased from private owners not a dealership are subject to sales tax of 635 or 775 for vehicles over.

Discounted Price Reduced Used Cars In Hartford Ct

Alfa Romeo Of Westport Miller Motorcars Authorized Alfa Romeo Dealer In Westport Ct

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

Motor Vehicle Assessments Town Of Fairfield Connecticut

Used Car Dealer In Stratford Bridgeport Norwalk Stratford Ct Wiz Leasing Inc

Best Cars Under 5 000 For Sale In Hartford Ct Cargurus

Pay Connecticut Car Taxes Our Ouch Map Hartford S Bill Seven Times Salisbury S For Same Car

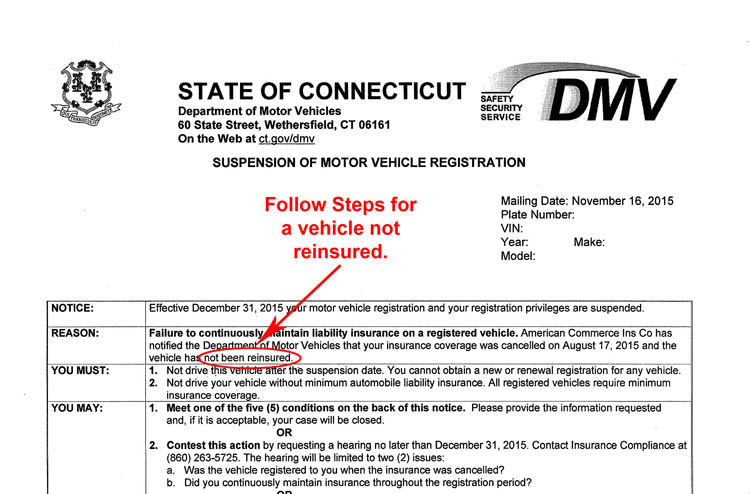

Learn How To Comply With Insurance Tax And Registration Laws Ct Gov

Car Buying Taxes Howstuffworks

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct

Bentley Greenwich Bentley Dealership Serving Greenwich Ct

Used Cars For Sale Bloomington Ca 92316 Save Money Auto Sales

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global

What Malloy S Proposed Trade In Automobile Tax Means For Connecticut Car Buyers Manchester Ct Patch

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

A Complete Guide On Car Sales Tax By State Shift